Can it be said there is a best lender structure in a given marketplace? For example, is there an inherent advantage or superiority to the loans originated for sale model versus loans originated for portfolio? As a contractor, should you care which model your lender uses?

Originating loans to hold in portfolio is the traditional role of banks – most people understand it – so let’s focus on origination for sale. The mortgage market is the most recognizable example of origination for sale, and it is growing despite recent events. Since the financial crisis, 9 in 10 mortgages have GSE involvement. Originating for sale creates specializations in the industry because the originators are not the owners and frequently not the servicers of the loans. This specialization has some positive effects; conforming mortgage rates are marginally lower than market rates outside the GSE (Government Sponsored Enterprise) world. Also, more mortgages may be made because funding can come from sources other than just banks.

And the mortgage market is just one example of many. Autos, boats, recreational vehicles, even home improvements, have finance participants engaged in originating loans for sale. But is this a net positive? I’ve been on both sides of the fence. At a previous institution, we nurtured a secondary market of community bank participants for our loans. It started inconsequential but became a monster. Accounting rules for loan sales mean immediate recognition of income at the time of the sale. It’s a bit like a drug habit; the cash is so immediate that everyone wants more. Plus, by offloading the risk of the loans to third parties, there is little downside….

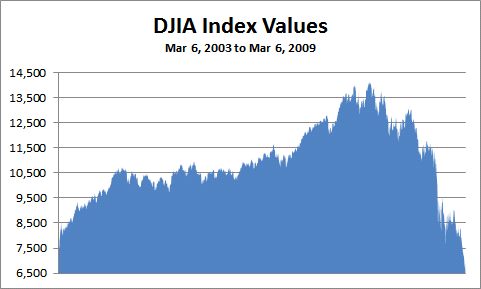

…that is, until a crash. The financial crisis was closely tied to the disintegration of the mortgage market, which begs the question: did origination for sale contribute?

Today, I’m conflicted about the origination for sale model. Whereas I remember the highs associated with gain-on-sale, I also remember the lows. Though the effect was indirect, my business at the time didn’t survive the meltdown. Now years later, I’m much more confident having chosen to hold our own loans. We are directly affected by our ability to understand and manage risk. It also creates the right incentives to act consistent with long-term success.

On a personal level, I choose a lender (and the associated lending model) based on whether I’m pursuing a transaction or a relationship. If a transaction, I’ll take that conforming mortgage, please. If a relationship, I’ll look more closely at having the institution hold and manage the risk of my loan. It helps me to feel comfortable that the relationship has greater potential to make it through the inevitable ups and downs of the marketplace.

As a contractor using financing, what have you done when confronted with that choice?

[/vc_column_text][/vc_column][/vc_row]